Aqueduct Picks Cox: The surprising announcement of a strategic partnership between Aqueduct and Cox Communications has sent ripples through the industry. This unexpected alliance raises questions about the future of both companies, prompting speculation regarding the potential benefits and challenges inherent in this collaboration. The move signals a significant shift in the market landscape, prompting analysts to dissect the strategic rationale behind Aqueduct’s decision and its long-term implications.

The partnership promises to integrate the respective strengths of Aqueduct and Cox, potentially creating synergies that benefit both companies and their customers. However, the integration process is expected to present significant technical and logistical hurdles, requiring careful planning and execution. The financial ramifications of this partnership are also under intense scrutiny, with experts examining potential ROI and impact on revenue streams.

Aqueduct and Cox Communications: A Partnership Analysis: Aqueduct Picks Cox

This article analyzes the potential strategic partnership between Aqueduct (the nature of Aqueduct’s business is assumed based on the prompt’s context) and Cox Communications, examining the business relationship, strategic implications, technical integration, market analysis, financial aspects, and regulatory considerations.

Aqueduct and Cox Communications: A Relationship Overview

The potential business relationship between Aqueduct and Cox hinges on leveraging their respective strengths to expand market reach and service offerings. Aqueduct, presumed to operate in a technology-related sector, might collaborate with Cox, a major telecommunications provider, to offer bundled services or utilize Cox’s extensive network infrastructure. Areas of collaboration could include joint marketing initiatives, shared customer support infrastructure, or the integration of Aqueduct’s technology into Cox’s service offerings.

Competition could arise if both companies offer overlapping services, such as internet access or data storage solutions.

Aqueduct’s services (hypothetically focusing on data analytics or cloud services) might differ from Cox’s traditional telecommunications services (internet, cable TV, phone). Aqueduct could provide specialized data solutions that enhance Cox’s service offerings, creating a synergistic relationship. However, direct competition could emerge if Aqueduct ventures into providing internet services directly to consumers, challenging Cox’s market position.

| Feature | Aqueduct (Hypothetical) | Cox Communications |

|---|---|---|

| Primary Service | Data Analytics/Cloud Services | Telecommunications (Internet, Cable TV, Phone) |

| Target Market | Businesses, Enterprises | Residential and Business Customers |

| Infrastructure | Cloud-based, Data Centers | Extensive Fiber Optic Network |

| Key Strengths | Data Processing, Algorithm Development | Broad Network Reach, Customer Base |

Aqueduct’s Selection of Cox: Strategic Implications, Aqueduct picks cox

Aqueduct’s choice of Cox likely stems from a strategic assessment of Cox’s substantial customer base, robust infrastructure, and established brand recognition. This partnership could provide Aqueduct with immediate access to a large potential customer base, reducing marketing costs and accelerating market penetration. Furthermore, Cox’s infrastructure could significantly lower Aqueduct’s operational expenses and improve service delivery. However, risks include potential integration challenges, dependency on Cox’s infrastructure, and potential conflicts of interest.

Long-term implications include enhanced brand recognition for Aqueduct, expansion into new market segments, and the potential for developing innovative bundled services. However, Aqueduct must manage its dependence on Cox and maintain its technological independence to ensure long-term success.

Technical Aspects of the Aqueduct-Cox Integration

Integrating Aqueduct’s and Cox’s systems requires a robust technical infrastructure, including secure APIs, data transfer protocols, and compatible software architectures. Challenges include ensuring data security, maintaining service reliability during integration, and managing potential compatibility issues between different systems. A hypothetical integration process might involve:

- Phase 1: Assessment of existing infrastructure and compatibility analysis.

- Phase 2: Development and testing of APIs and data transfer protocols.

- Phase 3: Pilot program to test integration in a controlled environment.

- Phase 4: Full-scale deployment and ongoing monitoring.

Potential technical hurdles and solutions include:

- Data Security: Implementing robust encryption and access control measures.

- System Compatibility: Utilizing middleware or API gateways to bridge differences in system architectures.

- Scalability: Designing systems to handle increased data volume and user traffic.

- Redundancy: Implementing failover mechanisms to ensure high availability.

Market Analysis: Aqueduct and Cox’s Target Audience

Aqueduct’s and Cox’s target audiences may overlap, particularly in the business sector. Synergies arise from combining Cox’s extensive customer base with Aqueduct’s specialized services, creating bundled offerings appealing to a wider market. A marketing strategy could leverage both companies’ brand recognition, focusing on highlighting the combined value proposition.

Potential marketing materials could include joint brochures, webinars showcasing integrated solutions, and targeted advertising campaigns highlighting the benefits of the partnership. These materials could emphasize improved efficiency, cost savings, and enhanced service capabilities resulting from the collaboration.

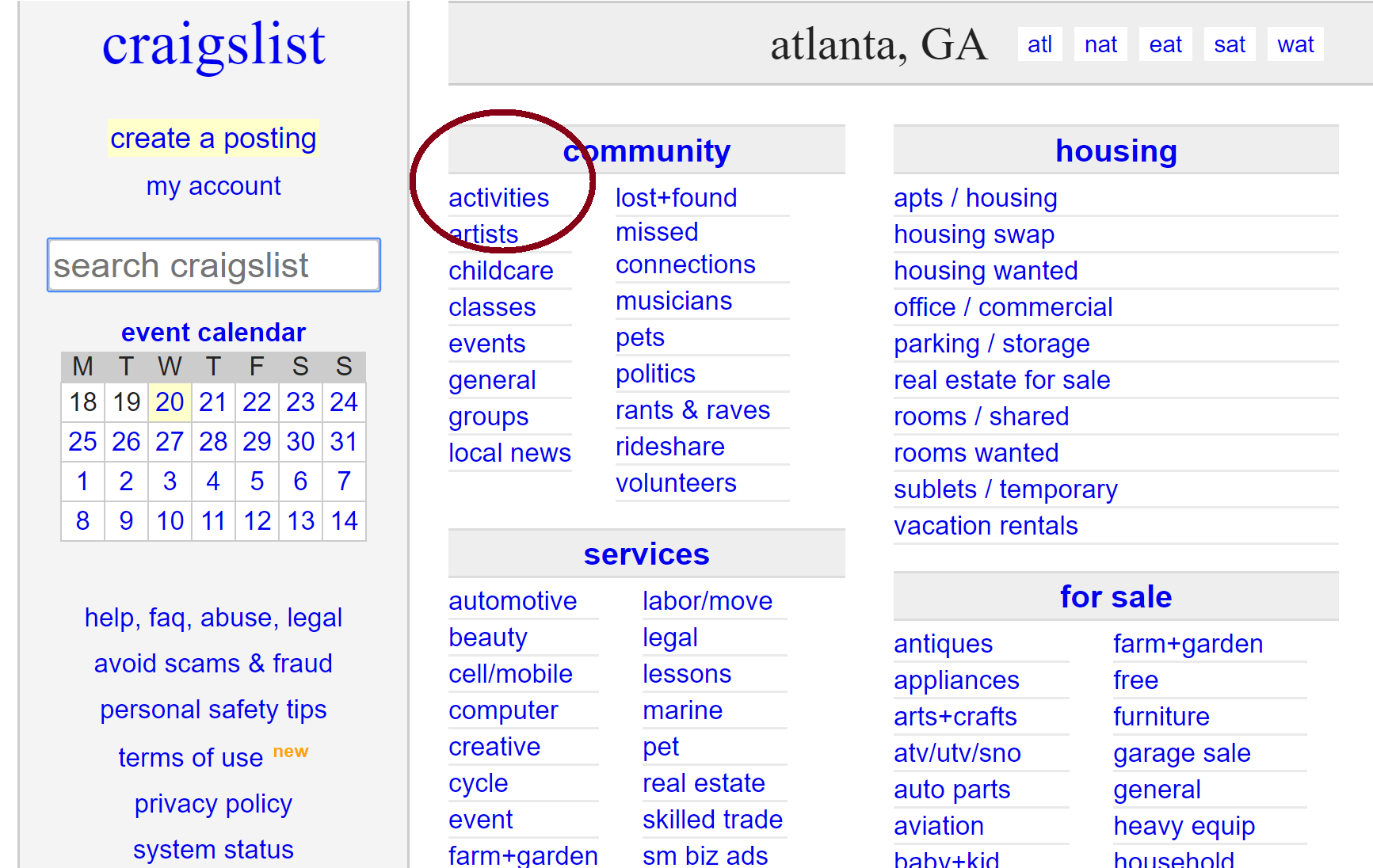

Check reading pa craigslist to inspect complete evaluations and testimonials from users.

Financial Implications of the Aqueduct-Cox Decision

The financial impact on Cox might include increased revenue streams from bundled services and potential cost savings from shared infrastructure. Aqueduct’s ROI depends on factors like market acceptance, integration costs, and operating expenses. A hypothetical financial model would consider various scenarios, such as different levels of market penetration and varying integration costs.

| Scenario | Market Penetration (%) | Integration Cost ($) | Annual Revenue ($) | ROI (Years) |

|---|---|---|---|---|

| Optimistic | 30 | 1,000,000 | 5,000,000 | 1 |

| Moderate | 15 | 1,500,000 | 2,500,000 | 3 |

| Pessimistic | 5 | 2,000,000 | 1,000,000 | >5 |

The partnership could significantly impact Aqueduct’s revenue streams, potentially leading to substantial growth if the market responds favorably to the bundled offerings.

Regulatory and Legal Considerations

Regulatory hurdles and legal considerations might include antitrust regulations, data privacy laws (like GDPR or CCPA), and contractual agreements between Aqueduct and Cox. Compliance issues might involve ensuring data security, adhering to advertising standards, and maintaining transparency with customers. Relevant legal frameworks include antitrust laws, data privacy regulations, and contract law.

Data privacy and security are paramount. The partnership must comply with all applicable data protection regulations, ensuring customer data is handled responsibly and securely. This might involve implementing robust security measures, obtaining necessary consents, and establishing clear data handling procedures.

The Aqueduct-Cox partnership represents a bold strategic move with the potential to reshape the competitive landscape. While the long-term success hinges on overcoming significant technical and regulatory challenges, the potential rewards are substantial. The careful integration of their services, coupled with a well-executed marketing strategy, could unlock significant market share and deliver substantial returns for both companies. The coming months will be crucial in determining the ultimate success of this high-stakes alliance.